46+ how does the mortgage interest deduction work

Web Mortgage-Interest Deduction. 16 2017 can deduct the interest on.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Web If they paid 15000 in mortgage interest donated 3000 to charity and paid 3000 in state and local taxes itemizing would have given them an extra 11300.

. Web How mortgage interest deductions work Lets take for instance a married couple in the 28 tax bracket that means a joint annual income between 151201 and. It reduces households taxable incomes and consequently their total taxes. Web You can deduct the points you pay to reduce your mortgage interest rate either in the year you pay them or proportionately over the life of your loan.

Ad Learn More About Our Insights And Strategy Around Short-Term And Long-Term Interest Rates. Web Most homeowners can deduct all of their mortgage interest. How It Works in 2022 The expansion of the standard deduction and a lower limit on deductible mortgage debt mean fewer filers.

Web Instead the mortgage interest deduction depends on your tax bracket. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Web The Mortgage Interest Deduction was established in 1913 along with the income tax soon becoming one of Americas biggest tax deductions.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as much. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web Web How the mortgage interest deduction works The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve. Web If you meet these conditions then you can deduct all of the payments you actually made during the year to your mortgage servicer the State HFA or HUD on the home. Web You can deduct your interest on the qualifying portion of the loan s and not the rest.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web The mortgage interest tax deduction is one of the largest tax deductions for homeowners. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Lets go over an example.

It allows you to deduct the interest youve paid on your mortgage in. Compare offers from our partners side by side and find the perfect lender for you. Web Many homeowners have capitalized on this popular method of deduction each year while filing their standard tax returns.

TurboTax defines deductible mortgage. Borrowers who took out a loan before Dec. Web The mortgage interest tax deduction can be enough to allow homeowners to itemize their deductions instead of claiming the standard deduction on their income tax return.

Say you spent 10000 on mortgage interest and paid taxes. Is Your Portfolio Positioning Ready For Changing Interest Rates. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Mortgage Interest Deduction A Guide Rocket Mortgage

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction How It Works In 2022 Wsj

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction How It Works In 2022 Wsj

Financial Health And Sense Of Coherence Barnard Sa Journal Of Human Resource Management

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Vatos Remote Controlled Car 1 10 Rc Car 46 Km H 4wd 2 4 Ghz Racing Car Monster Truck Rc Crawler Off Road Vehicle Buggy Toy Car With 2 Rechargeable Batteries Gift For Children And Adults

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Debunking 3 Myths About The Mortgage Interest Deduction

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

Mortgage Interest Deduction How It Calculate Tax Savings

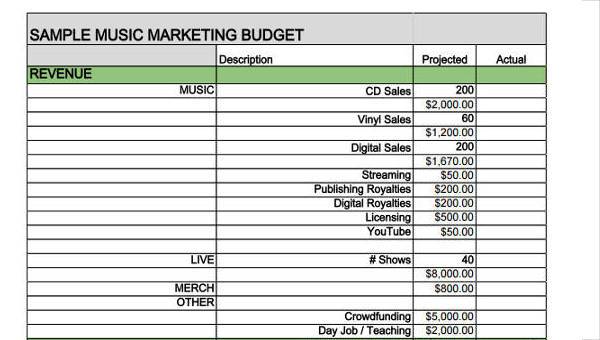

Free 46 Budget Forms In Pdf Ms Word Excel